The phrase “no tax on overtime” has. been spreading quickly across social media, news platforms and workplace conversations. Many workers are asking the same question: Is overtime really tax free now? If you work extra hours and depend on overtime pay, this topic directly affects your paycheck.

The short answer is this: overtime is not completely tax free, but a new federal law provides a tax deduction for certain overtime earnings. This change, often called the no tax on overtime law in the USA, is designed to help workers keep more of what they earn when they put in extra hours.

In this guide, we will explain everything in simple language. You will learn how overtime is normally taxed, what the new overtime tax deduction 2025 includes, who qualifies, how much you can deduct and what this means for your real take home pay. By the end, you will clearly understand whether this new overtime tax relief bill benefits you.

What Is the “No Tax on Overtime” Law?

The term no tax on overtime refers to a federal tax change that allows eligible workers to deduct a portion of their overtime premium pay from their federal taxable income.

This does not mean overtime is fully tax free. Instead, it creates a qualified overtime deduction that reduces how much of your income is subject to federal income tax.

In simple terms:

The new overtime tax law allows eligible workers to deduct part of their overtime premium pay from their federal taxable income, lowering their income tax bill.

This change applies only to federal income tax, not to Social Security or Medicare taxes. It is also temporary, covering tax years from 2025 through 2028 unless extended.

The goal of the law is to provide overtime tax relief and encourage extra work without heavily taxing the additional earnings.

How Overtime Is Normally Taxed

Before understanding the new overtime income tax exemption rules, it is important to know how overtime pay is usually taxed.

When you work overtime, you are typically paid time and a half. That means if you earn $20 per hour, your overtime rate is $30 per hour.

However, overtime pay is taxed just like regular wages. That includes:

- Federal income tax

- State income tax (if your state has one)

- Social Security tax

- Medicare tax

Many workers believe overtime is taxed more heavily. In reality, it is not taxed at a higher rate — it simply increases your total income, which can push you into a higher tax bracket temporarily.

For example:

If you earn $50,000 per year and make an extra $8,000 in overtime pay, your taxable income becomes $58,000. That higher income could slightly increase your federal tax bill.

This is where the overtime tax changes come into play.

How the Overtime Tax Deduction Works

The new overtime premium deduction applies only to the extra portion of overtime pay, the premium above your regular hourly wage.

Let’s break that down.

If your regular pay is $20/hour and your overtime pay is $30/hour:

- $20 is your base pay

- $10 is your overtime premium

Only the $10 premium portion qualifies for the deduction.

Deduction Limits

The law includes caps on how much you can deduct:

| Category | Deduction Limit |

| Single Filers | Up to $12,500 |

| Married Filing Jointly | Up to $25,000 |

| Applies To | Federal income tax only |

| Active Years | 2025–2028 |

There are also income phase out rules. The deduction begins to reduce if your income exceeds certain limits (for example, higher earners may not qualify for the full amount).

This is why understanding the overtime deduction limits is important before planning your tax savings.

Who Qualifies for the Overtime Tax Benefit?

Not everyone automatically qualifies for the full overtime tax benefit 2025.

To be eligible:

- You must receive qualified overtime pay

- The overtime must meet federal labor law definitions

- You must file a federal tax return

- Your income must fall below the phase out thresholds

Self employed individuals may not qualify in the same way as hourly employees.

If you work for an employer and receive legally defined overtime pay, you are likely eligible for the federal overtime tax rules under this law.

Is Overtime Completely Tax Free?

No. Overtime is not completely tax free.

Here is the clear breakdown:

- Federal income tax may be reduced through the deduction

- Social Security tax still applies

- Medicare tax still applies

- State income tax may still apply

So when people ask, “Is overtime tax free?” the honest answer is:

Overtime is not fully tax free. Only the overtime premium portion may qualify for a federal income tax deduction.

This distinction is extremely important to avoid confusion.

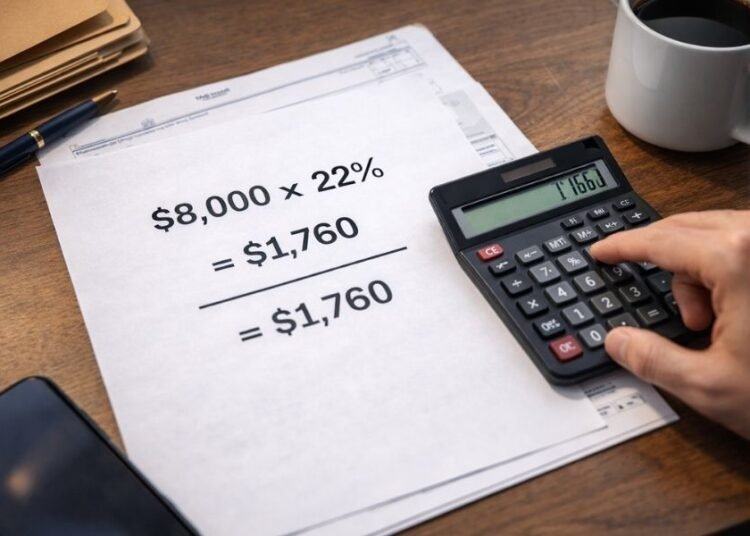

Real Life Example of Tax Savings

Let’s look at a simple example to understand how the overtime tax benefit 2025 might work.

Imagine:

- You earn $8,000 in overtime premium pay

- You are in the 22% federal tax bracket

If you deduct the full $8,000:

$8,000 × 22% = $1,760 potential federal income tax savings

That does not mean you receive $8,000 back. It means your taxable income is reduced by $8,000, lowering your tax bill by $1,760.

However, you would still pay Social Security and Medicare taxes on the full overtime amount.

This example shows how the new overtime tax law helps reduce income tax without eliminating payroll taxes.

Benefits of the No Tax on Overtime Law

The overtime tax relief bill provides several benefits.

More Take Home Pay

Workers who put in extra hours can keep more of their income after federal taxes.

Encourages Extra Work

Some employees may feel more motivated to accept overtime shifts knowing they receive tax relief.

Middle Class Support

The deduction mainly benefits hourly workers and middle income earners.

Temporary Relief

It provides short term assistance during economic pressure.

Limitations of the Law

While helpful, the law has clear limits.

It is Temporary

The deduction currently runs from 2025 to 2028.

Income Phase Out

Higher earners may see reduced benefits.

Not a Full Exemption

It does not eliminate payroll taxes.

State Taxes Still Apply

States are not required to follow federal overtime tax rules.

Understanding these limitations helps prevent unrealistic expectations.

What Workers Should Do Now

If you regularly earn overtime pay, here are smart steps to take:

- Review your pay stubs and track overtime premium amounts.

- Stay updated on IRS guidance about claiming the qualified overtime deduction.

- Consult a tax professional before adjusting withholding.

- Monitor income levels if you are near phase out thresholds.

Planning ahead ensures you maximize the benefits of the overtime income tax exemption rules without making costly mistakes.

Conclusion

The phrase no tax on overtime sounds simple, but the reality is more nuanced. Overtime pay is not completely tax free. Instead, the new law provides a federal income tax deduction for qualified overtime premium pay.

For eligible workers, this means lower taxable income and potentially meaningful savings. However, payroll taxes still apply, state taxes may apply and income limits can reduce eligibility.

Understanding how the overtime tax deduction 2025 works allows you to plan smarter, track your earnings accurately and make informed financial decisions.

If you earn overtime regularly, staying informed about the new overtime tax law could help you keep more of what you work hard to earn.

Frequently Asked Questions

Is overtime tax free in 2025?

No, overtime is not completely tax free in 2025. The law allows eligible workers to deduct qualified overtime premium pay from federal taxable income, but Social Security, Medicare and potentially state income taxes still apply.

How much overtime can I deduct?

Eligible single filers may deduct up to $12,500 in qualified overtime premium pay annually, while married couples filing jointly may deduct up to $25,000. These amounts are subject to income phase out thresholds and federal eligibility requirements.

Does the law remove Social Security taxes on overtime?

No. The no tax on overtime provision applies only to federal income tax calculations. Social Security and Medicare payroll taxes continue to be withheld from all overtime earnings, including both base wages and the premium portion.

Who qualifies for the overtime tax deduction?

Workers who receive overtime pay defined under federal labor laws and fall within income eligibility limits may qualify. The deduction applies specifically to the overtime premium portion and must be claimed when filing a federal tax return.

Is the overtime tax benefit permanent?

No, the current overtime tax deduction is temporary. It applies to tax years 2025 through 2028 unless extended by Congress. Future legislative action would be required to make the overtime tax relief permanent.

Do states follow the federal overtime tax rule?

Not automatically. Each state sets its own income tax policies. Some states may adopt similar overtime tax adjustments, while others may continue taxing overtime earnings under existing state income tax regulations.

I am Ali Ahmad, a Business Analyst and research based article writer with a Master’s degree in Business and Finance and over five years of professional experience. My work focuses on data driven analysis, market research and international business relations, with strong attention to global economic trends and financial systems. I specialise in analytical content that evaluates corporate strategies, cross border trade, market behaviour and financial decision making, delivering well structured, factual and insight driven articles.